As students look beyond high school to futures of loan payments and difficult economic decisions, many have found solace in taking time to earn a little extra money on the side. Anywhere from jobs to stocks, students have found ample opportunity to get a head start on their finances whether for their futures or for fun.

In a PHS survey of 71 students, 42.3% of students reported having a job, the majority of whom stated their reason for having one was to earn a little extra spending money. “At first I had a job because I wasn’t doing a sport in the fall, so I kind of wanted to just have something to occupy my time. I thought the idea of getting money was kind of fun and cool. I just wanted to save up. I still don’t know what I’m saving up for, probably college,” said junior Brienna Sotelo.

Working mostly Fridays and Saturdays at Fenton’s, Sotelo sacrifices fun weekends with friends for work but still manages to enjoy her time. “I like how simple the job is and how fun. I mean, you’re making ice cream. So it’s, I find it fun and I love all my coworkers, and the hours aren’t too long,” Sotelo said.

Senior Frankie Broening works as a lifeguard for the Claremont Country Club and keeps her paychecks for future expenses. “It allows me to save my own money for college and for after college…” said Broening, “lifeguarding is a pretty good job. It’s pretty easy. I had to pay for the training, which was kind of annoying, but I do get paid pretty well.”

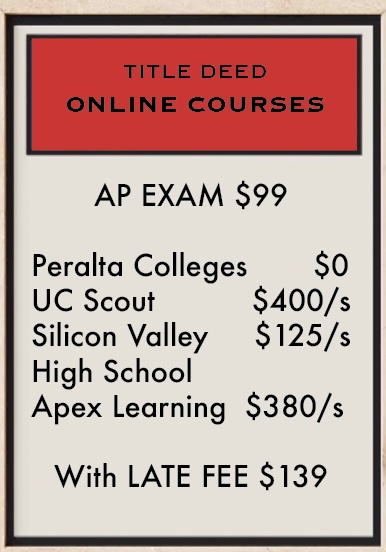

While a minority of students report having a job, those who do report jobs varying from side gigs like babysitting to more formal jobs like working at a gym, which requires students to fill out w-4 and 1040 forms.

With restaurants nationally suffering from labor shortages as a result of the pandemic, may turn to high schoolers as a supplementary option for staffing.“All restaurants need help mostly on Fridays and Saturday nights, which is when I work, so that’s a little bit annoying as a high schooler because then I miss out on games or just hanging out with my friends on the weekend,” said Sotelo.

But jobs aren’t the only way PHS students have found to make quick cash. Some have opted for a more lucrative position: trading stocks. Sophomore Arun Brahma says he would rather have his money work for him than the other way around. “I like watching my stocks grow, obviously,” Brahma said, “and I like how it makes me be more aware of the economy and what’s going on in the economy because I have to follow the stocks that I’m trading.”

But with a much higher risk rate, Brahma said “You shouldn’t trade any money that you’re going to anticipate needing because you can always lose it. It should always be extra money and nothing that you’re going to need in at least the first couple years.”

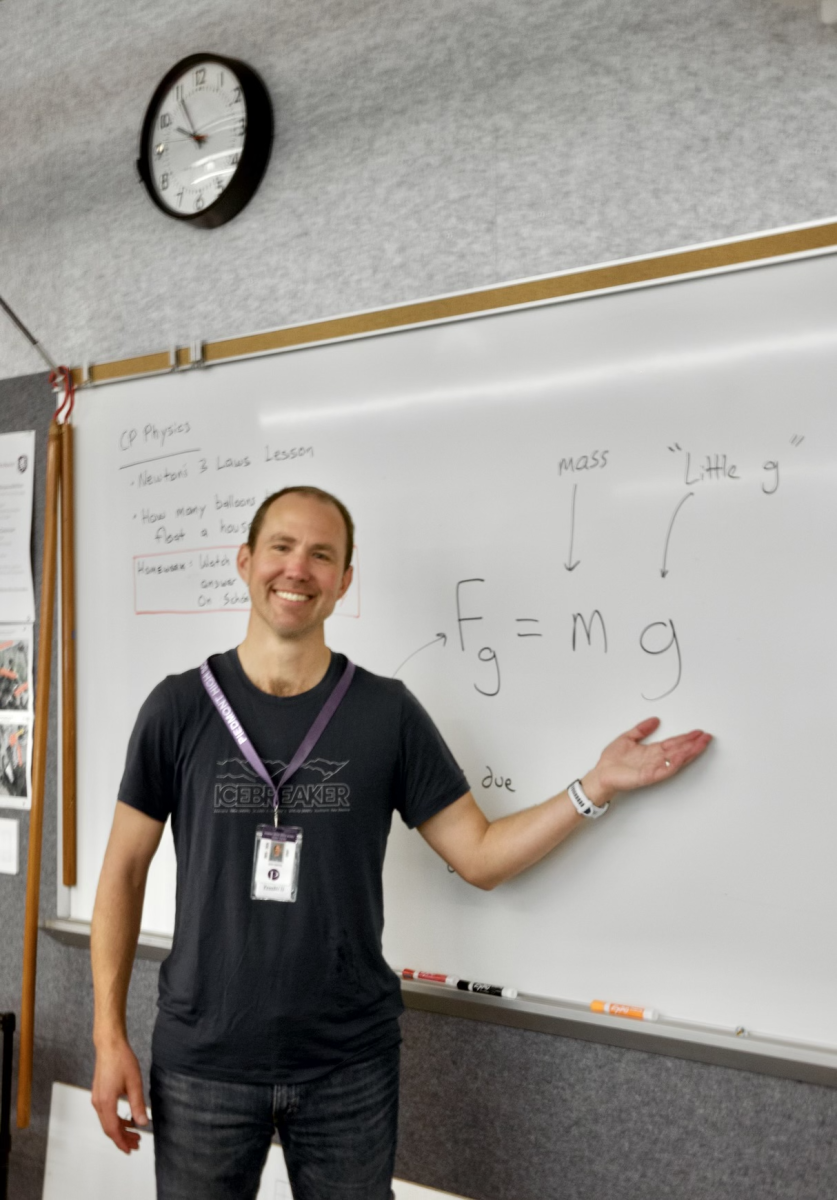

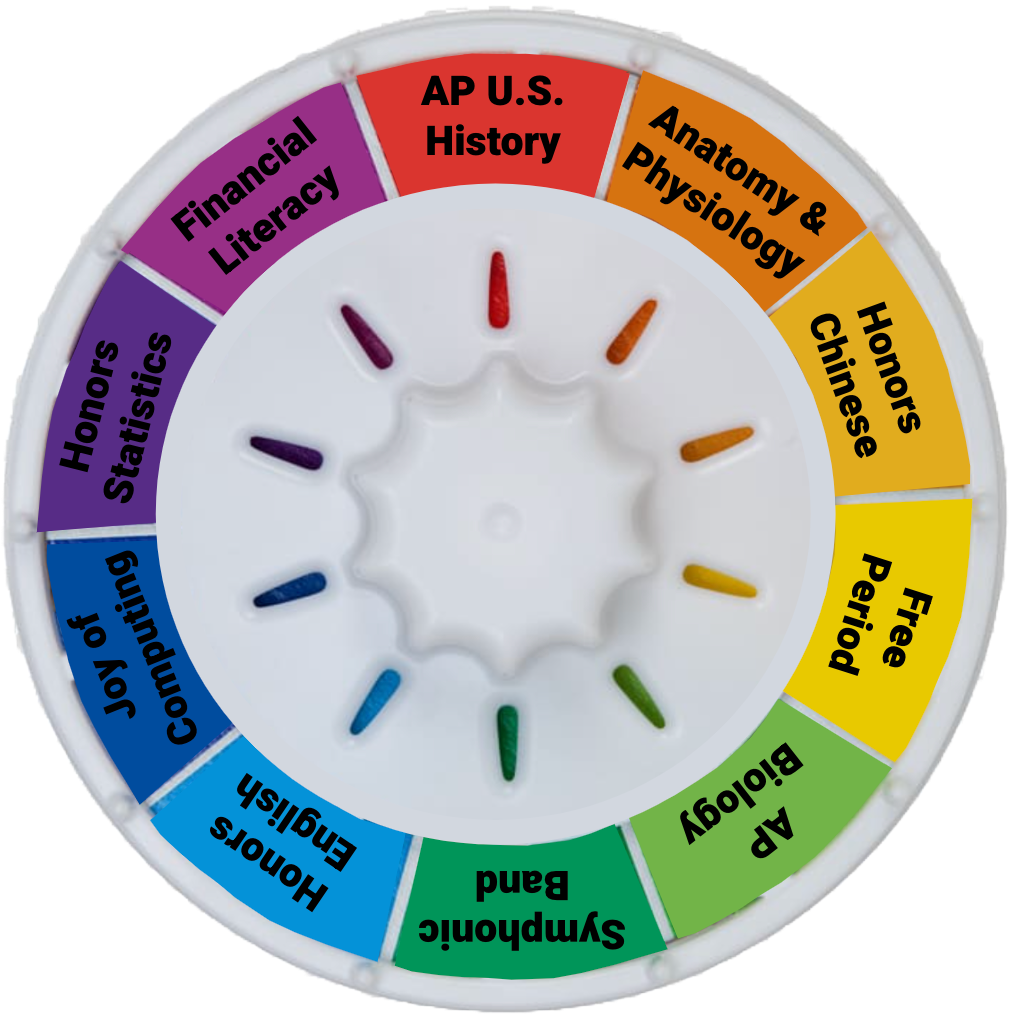

Recognzinig an uptick in student interest in financial responsibility, social studies and economics teacher Gabrielle Kashani has begun instructing financial literacy classes this semester. A course that was originally proposed in the 2019-2020 school year, Financial Literacy was postponed due to COVID-19. The course aims to allow students to introduce students to the basics of economics and financial literacy, from learning how to fill out paperwork for jobs to investment in the stock market.

“I think [the financial literacy course] is important for students because I do think that the point of school is to prepare you for real life and the real world…” said Kashani, “It’s common for teenagers who have little real-world experience to have a lack of awareness.”

Yet even with these strides at PHS to bridge this financial learning gap, the United States remains below average in comparison to other countries when it comes to performance in these classes based on results from an OECD study. In regards to the Financial Literacy Program Kashani said.

“I think that people can avoid financial pitfalls, which are some of the things that you don’t realize are happening to you until after they happen to you and then also think about saving and investing early on for retirement.” And with students gaining more opportunities to work as they go through high school, programs like Financial Literacy and Economics may see a rise in popularity among teens in coming years. “Having a job is a worthwhile practice and endeavor for teenagers. Just to attach the sense of like, ‘Ah, I’m making $15 an hour.’” said Kashani.