The Piedmont Board of Education has placed a parcel tax increase called Measure P on the November ballot to combat budgeting challenges in Piedmont schools.

Measure P would increase the parcel tax on Piedmont homes from $0.25 per square foot to $0.50 per square foot, raising over $5 million for Piedmont Schools annually, doubling current revenue.

A parcel tax is a form of property tax that is not based on property value like other such taxes but instead based on the square footage of a given parcel of land.

According to the official language of the bill, the funds will be used, “To attract and retain highly qualified teachers and educational support staff and continue funding advanced academic programs.”

Last academic year, PUSD laid off twelve staff members across the district in addition to multiple staff choosing not to return for the 2024-2025 academic year. Many staff had to be let go or couldn’t sustain working in Piedmont after $1.2 million dollars of cuts to the education budget last year. More cuts could be on the way if the measure isn’t passed.

“If we don’t get Measure P, it’s estimated that just to meet current expenses, the district will have to cut about $2 million out of its budget,” said Association of Piedmont Teachers(APT) President Doctor Elise Marks. “If we have to cut $2 million dollars more, we will maybe be able to run our high school graduation requirements and nothing else.”

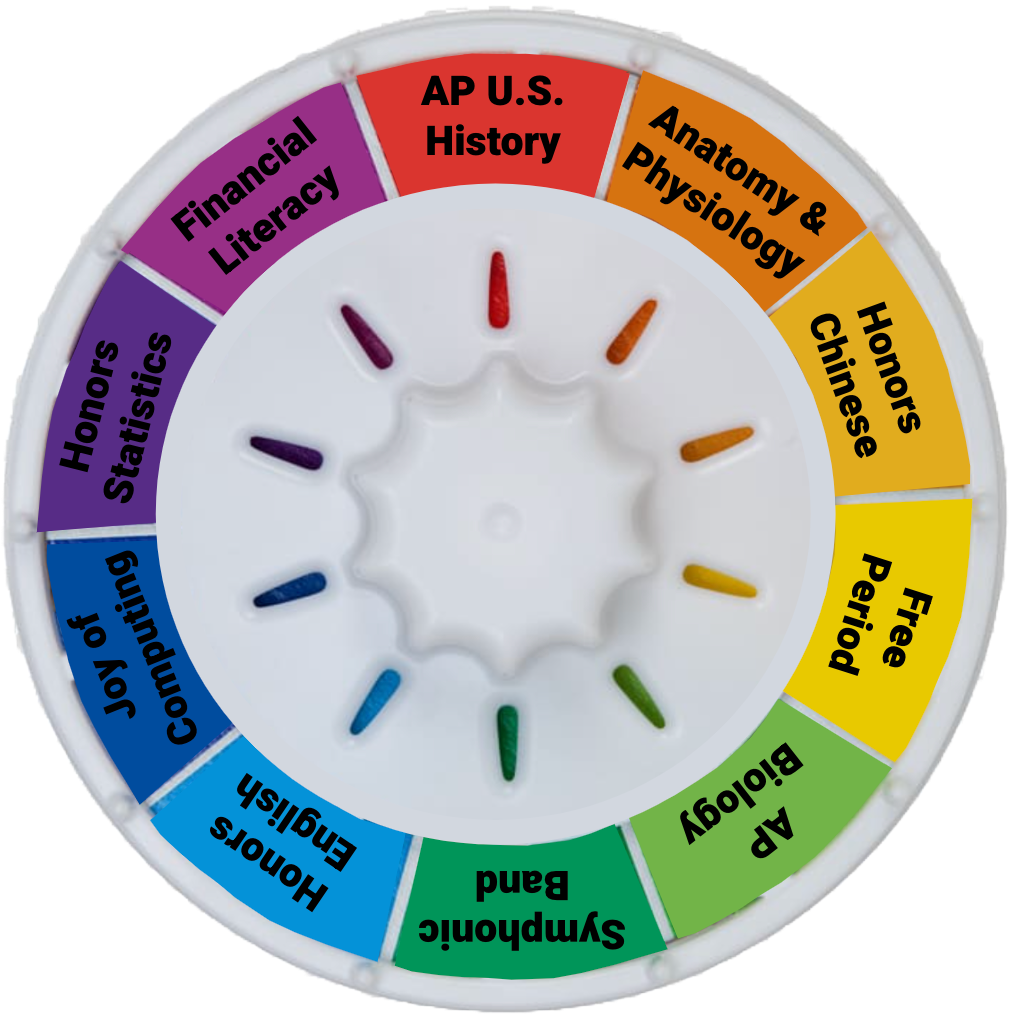

That would mean only rudimentary Art, Computer Science, and STEM programs would be offered for students, said Marks

Where does funding for Piedmont schools come from and why does Piedmont need more of it?

Piedmont Unified School District receives less funding than other school districts through a system known as Local Control Funding Formula (LCFF). LCFF allocates funds to California school districts based on the presence of high-need students like those who speak English as a second language, or in the foster care system. Piedmont lacks a large number of these students and therefore receives less funding. Due to these challenges with receiving funding from the state, the city looks to alternative methods of funding, like parcel taxes.

“We have the largest parcel taxes of anywhere in the state, but we desperately need it. Because the expectation of the community is that we are going to offer really robust programs and operate academically at a high level and provide a lot of support services for students,” said Marks

Piedmont has many parcel taxes, but two taxes, Measure G and Measure H, specifically fund education in the city. The latest iteration of such taxes was passed in 2020. Measure G applied a flat yearly rate on homeowners and Measure H placed a $0.25 parcel tax per square foot on buildings in Piedmont. Measure P would replace the current Measure H and Piedmont homeowners would be expected to pay an average of $55 a month with an annual cost of $655 were the bill to pass in November.

How does the community feel about Measure P?

Preliminary polling shows that 80 percent of residents surveyed would vote in favor of the parcel tax increase, demonstrating more than the required 66.7 percent majority needed to pass increases on taxes in California, said Piedmont Board of Education President Veronica Anderson Thigpen.

Many community members have taken part in advocating for the passage of Measure P.

“I think it’s very important that the district has the ability to retain and attract high-quality teachers and keep our educational program incredibly strong for our college-bound students and for students who need extra support in the classroom,” said co-chair of the Friends for Piedmont Schools in Support of Measure P Clare Arno.

While providing extra funding for teachers, other factors result in the loss of faculty and failure to attract potential new hires.

How does Measure P affect Piedmont’s teachers?

“[Up until 2011] the district paid our health insurance entirely,” said Marks

Now, staff pay out of pocket.

As stated in the bill’s language, a key goal of Measure P is to use the increased revenue to maintain and attract new staff to PUSD. This comes as a direct response to APT demands for a higher wage for staff. After months of negotiation, members of the district and union agreed to a four percent raise for this year. The district also negotiated a four-and-a-half percent raise for staff for next year.

But that raise is contingent on Measure P passing, said PUSD Superintendent Dr. Jennifer Hawn.

Should Measure P fail to pass, the district will have to implement a lower raise for staff. Salaries play a key role in maintaining a high standard of education for Piedmont Schools.

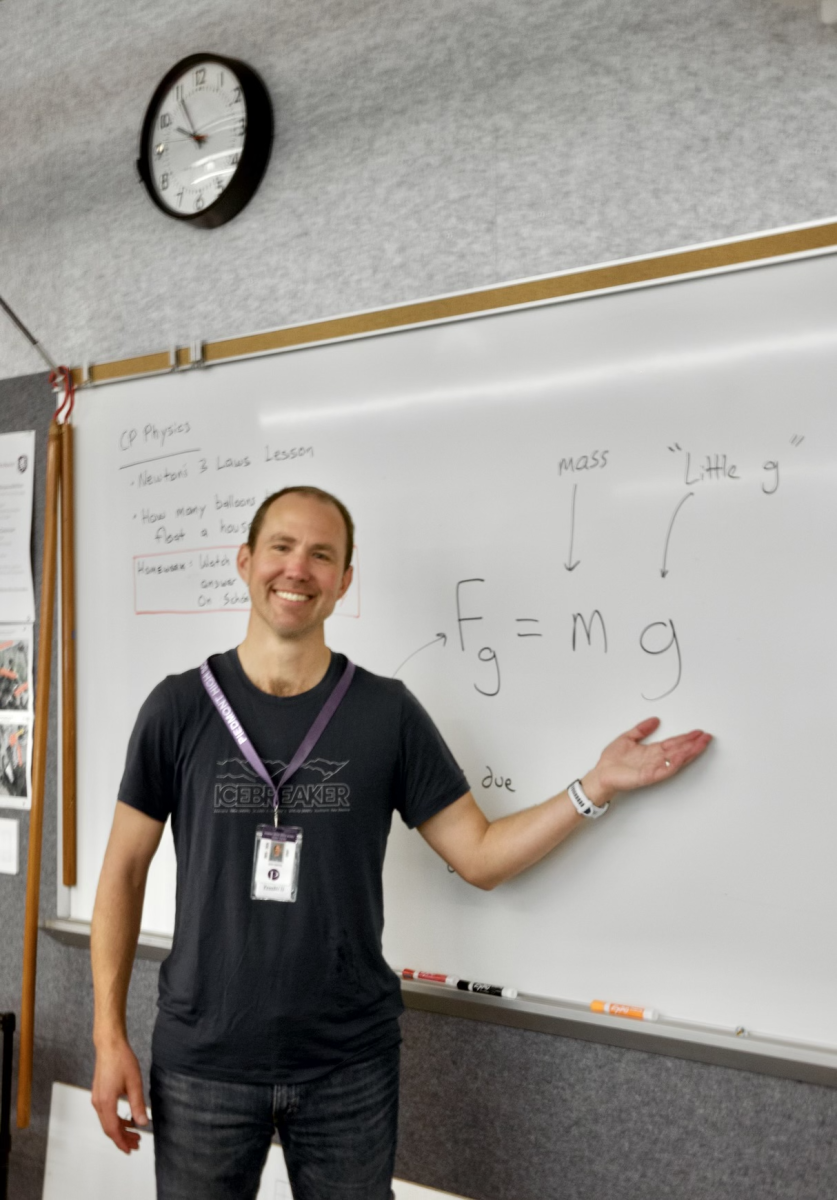

“When the salaries are higher, it makes [Piedmont] more attractive to new staff coming in. The goal is to increase our salaries as much as possible so that we attract and hold onto the best teachers and staff,” Hawn said.

Salary isn’t the only benefit that the staff receive from the district. A portion of healthcare costs is also covered by the district, an amount which increased this academic year and will increase again next year.

Now, the district will cover, on average, 86% of healthcare costs compared to last year’s 84%, said PUSD Chief Business Officer, Ruth Alahydoian. Depending on the plan the district may cover as low as 78% or as high as 100%, Alahydoian said.

The healthcare increases are not dependent on Measure P passing as with the four-and-a-half percent raise.

The Piedmont Board of Education has placed a parcel tax increase called Measure P on the November ballot to combat budgeting challenges in Piedmont schools.

Measure P would increase the parcel tax on Piedmont homes from $0.25 per square foot to $0.50 per square foot, raising over $5 million for Piedmont Schools annually, doubling current revenue.

A parcel tax is a form of property tax that is not based on property value like other such taxes but instead based on the square footage of a given parcel of land.

According to the official language of the bill, the funds will be used, “To attract and retain highly qualified teachers and educational support staff and continue funding advanced academic programs.”

Last academic year, PUSD laid off twelve staff members across the district in addition to multiple staff choosing not to return for the 2024-2025 academic year. Many staff had to be let go or couldn’t sustain working in Piedmont after $1.2 million dollars of cuts to the education budget last year. More cuts could be on the way if the measure isn’t passed.

“If we don’t get Measure P, it’s estimated that just to meet current expenses, the district will have to cut about $2 million out of its budget,” said Association of Piedmont Teachers(APT) President Doctor Elise Marks. “If we have to cut $2 million dollars more, we will maybe be able to run our high school graduation requirements and nothing else.”

That would mean only rudimentary Art, Computer Science, and STEM programs would be offered for students, said Marks

Piedmont Unified School District receives less funding than other school districts through a system known as Local Control Funding Formula (LCFF). LCFF allocates funds to California school districts based on the presence of high-need students like those who speak English as a second language, or in the foster care system. Piedmont lacks a large number of these students and therefore receives less funding. Due to these challenges with receiving funding from the state, the city looks to alternative methods of funding, like parcel taxes.

“We have the largest parcel taxes of anywhere in the state, but we desperately need it. Because the expectation of the community is that we are going to offer really robust programs and operate academically at a high level and provide a lot of support services for students,” said Marks

Piedmont has many parcel taxes, but two taxes, Measure G and Measure H, specifically fund education in the city. The latest iteration of such taxes was passed in 2020. Measure G applied a flat yearly rate on homeowners and Measure H placed a $0.25 parcel tax per square foot on buildings in Piedmont. Measure P would replace the current Measure H and Piedmont homeowners would be expected to pay an average of $55 a month with an annual cost of $655 were the bill to pass in November.

Preliminary polling shows that 80 percent of residents surveyed would vote in favor of the parcel tax increase, demonstrating more than the required 66.7 percent majority needed to pass increases on taxes in California, said Piedmont Board of Education President Veronica Anderson Thigpen.

Many community members have taken part in advocating for the passage of Measure P.

“I think it’s very important that the district has the ability to retain and attract high-quality teachers and keep our educational program incredibly strong for our college-bound students and for students who need extra support in the classroom,” said co-chair of the Friends for Piedmont Schools in Support of Measure P Clare Arno.

While providing extra funding for teachers, other factors result in the loss of faculty and failure to attract potential new hires.

While providing extra funding for teachers, other factors result in the loss of faculty and failure to attract potential new hires.

“[Up until 2011] the district paid our health insurance entirely,” said Marks

Now, staff pay out of pocket.

As stated in the bill’s language, a key goal of Measure P is to use the increased revenue to maintain and attract new staff to PUSD. This comes as a direct response to APT demands for a higher wage for staff. After months of negotiation, members of the district and union agreed to a four percent raise for this year. The district also negotiated a four-and-a-half percent raise for staff for next year.

But that raise is contingent on Measure P passing, said PUSD Superintendent Dr. Jennifer Hawn.

Should Measure P fail to pass, the district will have to implement a lower raise for staff. Salaries play a key role in maintaining a high standard of education for Piedmont Schools.

“When the salaries are higher, it makes [Piedmont] more attractive to new staff coming in. The goal is to increase our salaries as much as possible so that we attract and hold onto the best teachers and staff,” Hawn said.

Salary isn’t the only benefit that the staff receive from the district. A portion of healthcare costs is also covered by the district, an amount which increased this academic year and will increase again next year.

Now, the district will cover, on average, 86% of healthcare costs compared to last year’s 84%, said PUSD Chief Business Officer, Ruth Alahydoian. Depending on the plan the district may cover as low as 78% or as high as 100%, Alahydoian said.

The healthcare increases are not dependent on Measure P passing as with the four-and-a-half percent raise.